What is Moving Insurance?

Moving insurance provides you with coverage in the event some of your belongings are lost, stolen or broken during your move. This is additional coverage that YOU purchase to cover your goods during transit and provides additional coverage over and above that provided by your moving company. Different plans provide different levels of coverage:

Weight-based Coverage

This type of policy pays claims based upon the weight of the item damaged. For example, if your buddy loses his grip on your 50 pound dining room glass table and it plummets down the stairs and shatters, you receive reimbursement based upon the table’s approximate weight. Many policies pay out between $.25-$.7/pound, so you would be looking at receiving between $12.50 and $35.00. Obviously, weight-based coverage probably isn’t the best option when it comes to moving insurance, because you would often still be out-of-pocket trying to replace your damaged pieces.

Assessed Value

Claims would be paid based upon the value of items at the time of damage. So, much like the insurance company wouldn’t write you a check for a brand new car when you total the run-down clunker you’ve been driving since college, it won’t write you a check for sticker value of whatever might get damaged during the move. Under this coverage, you’ll receive a check for the assessed value, or depreciated value, of the TV, desk, chair, etc.

Full Replacement Value

With this level of coverage, you will receive a check for whatever the insurance company believes it will cost you to replace the item. Back to the table your buddy dropped in the first scenario – with full replacement value insurance, you’ll receive enough money to go buy a brand new table to replace the one lost.

What is trip transit insurance?

Trip transit insurance covers your belongings during the move from theft or natural disasters, but does not cover items in the event of mere damage or breakage. Generally, a trip transit policy would cover the full value or your household goods, or would supplement the insurance coverage provided by your mover.

Why should I purchase moving insurance?

Well, you may not need to. While this is completely up to you, there are two important things to know before going out and buying a policy:

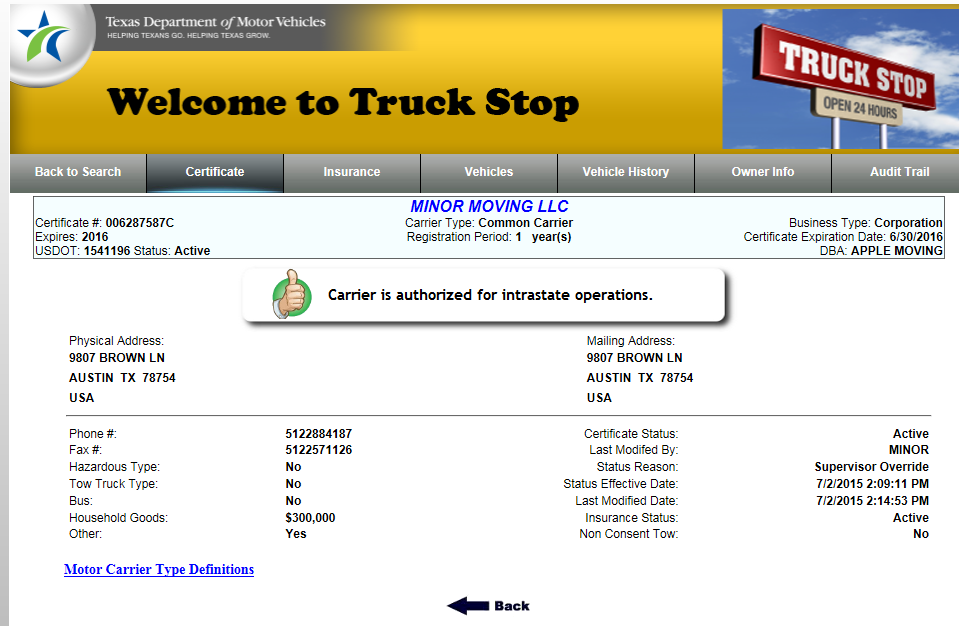

1. Any reputable moving company will be both licensed and insured. Texas moving companies must register with the Texas Department of Motor Vehicles. You can search the online database here https://apps.txdmv.gov/apps/mccs/truckstop/ to see the license status of various companies. While the TXDMV cannot settle moving related claims, by using a licensed mover, you do have the right to mediation of claims through the TXDMV. TXDMV also allows consumers to file an open records request to review the records of any commercial motor carrier.

Additionally, in Texas, licensed moving companies assume a standard liability of at least $.60/pound. This is different than the insurance coverage mentioned above. Any damage claims must be filed within 90 days of your move. After this time period, your claim may be denied. You can also use the TXDMV truckstop search to view a carrier’s insurance coverage information under the “certificate” and “insurance” tabs.

Apple Moving proudly complies with the state’s licensing and insurance requirements. You’ll find us under our parent company, Minor Moving:

2. Most renter’s and homeowner’s policies cover your belongings during the move and usually include coverage for most items for breakage or damage caused during the move. After your deductible is met, most policies pay full replacement value for items damaged, lost, or stolen. You’ll want to contact your agent prior to your move to make sure your coverage is sufficient and to discuss coverage for valuables or fragile pieces. Even if you are transporting valuables, like jewelry, yourself, you’ll want to make sure they are fully insured.

If you are a renter moving with roommates, don’t make the mistake of thinking your belongings will be covered under a policy held by a roommate just because you live together. An insurance company will not pay claims for the belongings of other individuals.

How do I make sure my coverage is sufficient?

Create a spreadsheet to inventory your household goods and approximate the value of furniture and other big-ticket items. Sum up your inventory and see where you come out relative to the coverage provided under the moving company’s policy or your personal homeowner’s or renter’s policy to assess whether you need to purchase additional coverage. Likely, between your personal coverage and the moving company’s policy, you’ll be covered for your move.

We hope this gives you some peace of mind as you approach your move! You can rest assured that if you’re moving with Apple, you are in good (and licensed and insured) hands.

Crazy Move, CBD/Photo by Paulimus via flickr

Do you need help with packing, unpacking, storage, or your entire move?

Request a free rapid quote for any moving services you may need. Get started today!